It’s been another crazy year in the world including challenges with the markets, your personal finances, inflation, supply chain, volatility, mental health, climate change, and that virus that just won’t go away. At Ripsaw® we have taken advantage of the productivity gains from remote work and continue to focus on our mission with balance and direction.

It’s been another crazy year in the world including challenges with the markets, your personal finances, inflation, supply chain, volatility, mental health, climate change, and that virus that just won’t go away. At Ripsaw® we have taken advantage of the productivity gains from remote work and continue to focus on our mission with balance and direction.

Ripsaw Mission

- Expand financial education to put people in control of their financial lives.

- Provide an independent, low-cost, self-directed, wealth portfolio software platform for everyone.

- Accelerate the shift from high percentage-based investment advisor fees to value-add tools for DIY investors and flat or hourly fee financial planners/advisors.

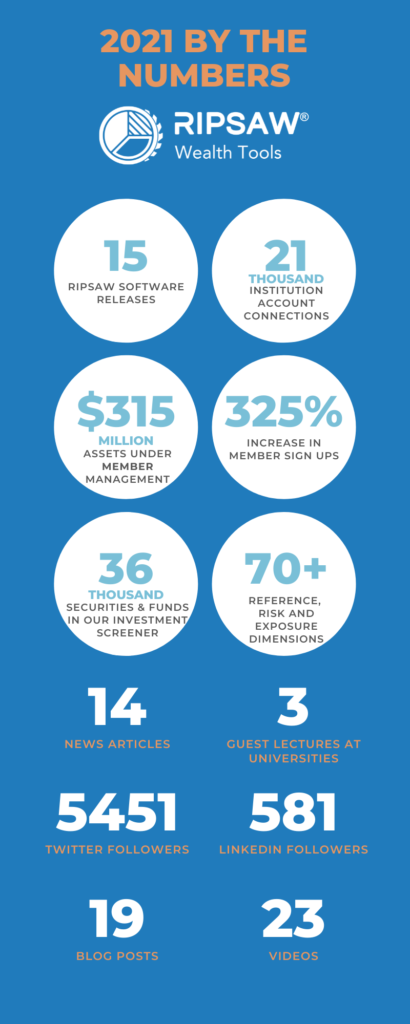

When we reviewed 2021 we were amazed at how much this independent startup has been able to achieve for the mission over the year. Here is a list of all the ways we worked to put people in control of their financial lives and provide them the software tools to make that possible.

Financial Education

Education Campaign

Teaching Financial Decisions as a Life Skill By Stanley J. Kon

Studies Show Only 16% of Millennials Understand Basic Financial Concepts By Hilary Kennedy

Guide to DIY Money Management (and When to Hire a Professional)

Avoid excess fees and risks by creating your own financial plan and portfolio. By Emma Kerr

University Guest Lectures

Reading

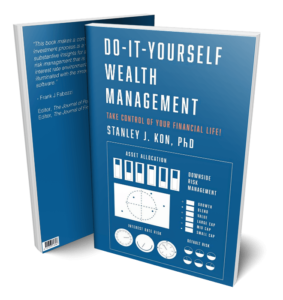

Stanley J. Kon, our Co-Founder and Chairman published the third revision to his book Do-It-Yourself Wealth Management.

Fall 2021 Book Review in the Journal if Investing

Tutorials & Case Studies

Using Ripsaw Assist™ in the Ripsaw Optimizer™ from Ripsaw on Vimeo.

The Eleanor Case Study – with Ripsaw Wealth Tools/DIY Wealth Management from Ripsaw on Vimeo.

Continuing to Build Ripsaw® Wealth Management Tools

A lot of great achievements for the wealth management software. Ripsaw® Wealth Tools formally graduated from private beta to a public full featured platform in early 2021.

- The most advanced tools debuted with the announcement of the Ripsaw Optimizer™ and Assist™ tools in v1.5.

- We introduced the Holdings View providing a holistic view of your investment across all accounts with filtering and dynamic allocation charts.

- We added many types of manual account types and improved the settings for all accounts.

- We launched mobile web and iOS apps for monitoring your personal wealth on the go!

- We improved Ripsaw’s speed and performance significantly with Ripsaw v1.6 and upgraded much of the underlying platform to grow well and stay fast for years to come.

- Lots of great UI/UX improvements to the Balance Sheet, Accounts, and Portfolio Wealth Dashboard.

- Improved onboarding significantly. Embedded help, knowledge base, and tutorials right in Ripsaw®. Added clear and easy subscription choice and payment entry. We even support Apple Pay and Google Pay now!

- Ripsaw got Data Quality Alerts and advanced Investment Data Management with Ripsaw v1.7.

- Launched the DIY Wealth Management Blog!

- Launched the new RIPSAW.CO

- And most importantly we increased our member bases significantly reaching Assets Under Member Management to ~ $315 million. Thanks to all our members and beta testers for providing so much great feedback this year!

- We have a great Road Map in store for 2022 and beyond!

Awareness Campaign

Ripsaw® Wealth Tools Announces Launch of iOS App Empowering Wealth Management From Anywhere

Fireside chat with Stanley J. Kon, Chairman at Ripsaw LLC

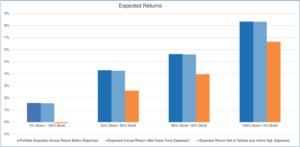

Fees and Wealth Accumulation

Compelling Case for Ripsaw® Wealth Tools

Here’s to a great 2021 and an even better 2022!

Happy new year!

-The Ripsaw Team