Managing your cash, bond, stock, and real asset allocation; the composition of your stock and bond sub portfolios; global exposures; bond default, interest rate and sector risks; stock capitalization, growth, value, and sector tilts involves a lot of moving parts. The goal is to provide a toolset that reduces complexity but maintains flexibility so the user can focus on good decisions. This requires a disciplined investment process. Discipline is achieved by having a benchmark strategic asset allocation consistent with investment objectives and risk tolerance as a target. Then risk is measured by actual portfolio risk exposure deviations from your benchmark Strategy. No deviations imply no incremental risk. However, investment restrictions, private investments, pensions, social security, tactical trades, and tax implications are examples of reasons why there will have to be deviations, but the goal of minimizing risk exposure deviations will provide superior portfolio strategies.

The Ripsaw® Optimizer™

An Innovative Portfolio Optimization Toolkit

Built on Portfolio Revisions

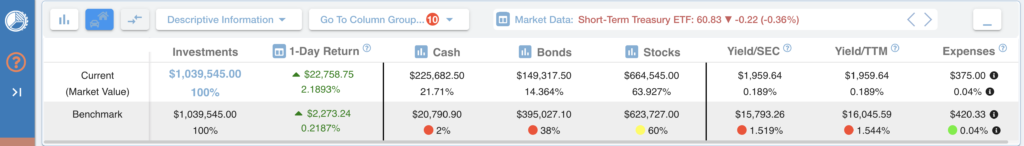

THE WEALTH PORTFOLIO DASHBOARD

The wealth portfolio dashboard provides indicators to monitor all the risk exposures in your current portfolio. When a risk exposure in your portfolio deviates beyond a threshold level from that in your benchmark portfolio, a set of rebalancing trades are required to bring your portfolio into alignment. Entering Portfolio Revision Mode displays a revision section where the user can change the amount to be invested in each security in each account. In Revision Mode, the wealth portfolio dashboard now contains a revised portfolio line with risk exposures recalculated as you enter each investment revision (what if?) decisions. Then you can compare the net effect of all revision decisions on all risk exposures at the portfolio level with those of your benchmark strategy. Given investment restrictions, the goal of portfolio rebalancing is to get as close as possible to your set of benchmark risk dimensions.

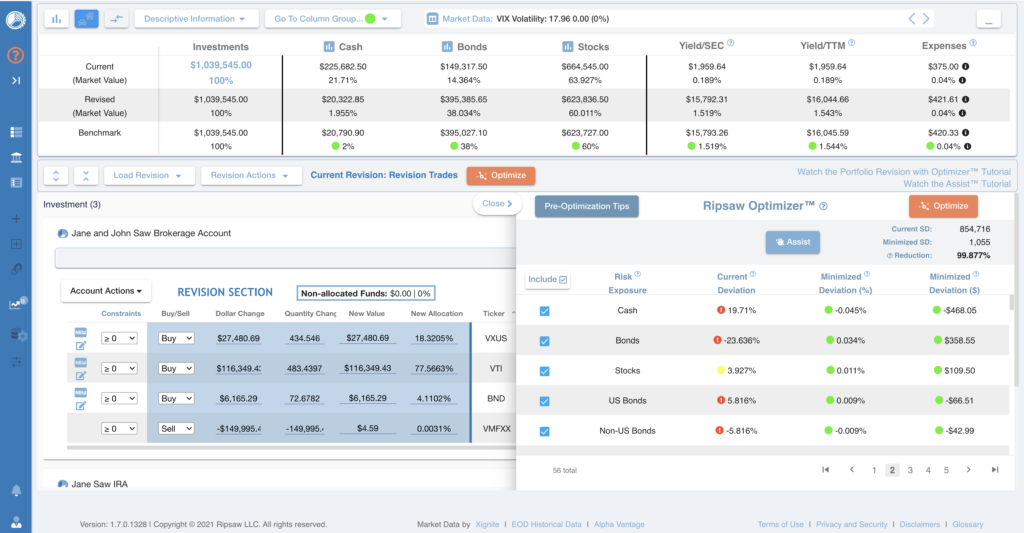

REVISION MODE

The wealth portfolio dashboard provides indicators to monitor all the risk exposures in your current portfolio. When a risk exposure in your portfolio deviates beyond a threshold level from that in your benchmark portfolio, a set of rebalancing trades are required to bring your portfolio into alignment. Entering Portfolio Revision Mode displays a revision section where the user can change the amount to be invested in each security in each account. In Revision Mode, the wealth portfolio dashboard now contains a revised portfolio line with risk exposures recalculated as you enter each investment revision (what if?) decisions. Then you can compare the net effect of all revision decisions on all risk exposures at the portfolio level with those of your benchmark strategy. Given investment restrictions, the goal of portfolio rebalancing is to get as close as possible to your set of benchmark risk dimensions.

When you complete a revision, you can save it and see a summary of the trades to execute at your financial institutions.

The Revision Toolset provides the infrastructure for managing your complete wealth picture. You can make changes across any of your accounts and see what the effects will be in the Wealth Portfolio Dashboard. Ripsaw’s Innovative Optimizer™ and Assist™ Tools take DIY Wealth Management to the next level. The purpose is to do all the analytical work and most of the thinking for you.

The Optimizer™

The Optimizer™ solves for the allocation of wealth among the available investments in all accounts simultaneously with one click! The objective of the algorithm is to minimize the sum of portfolio risk exposure deviations from those in your benchmark strategic asset allocation strategy.

Typical asset allocation models are based on assumption-burdened statistical estimates of risk and expected return with opaqueness designed to make individuals think only paid professionals can understand their complexity and feed their cookie-cutter products that are efficient for them, but not you. These few reusable buckets do not consider your other assets and liabilities not under their management, unique individual circumstances, or constraints. The opaqueness is further exemplified by a lack of reporting net of fee risk-adjusted performance measurement and attribution.

Typical asset allocation models are based on assumption-burdened statistical estimates of risk and expected return with opaqueness designed to make individuals think only paid professionals can understand their complexity and feed their cookie-cutter products that are efficient for them, but not you. These few reusable buckets do not consider your other assets and liabilities not under their management, unique individual circumstances, or constraints. The opaqueness is further exemplified by a lack of reporting net of fee risk-adjusted performance measurement and attribution.

Ripsaw’s disciplined investment process is an open book. It employs observable, economically intuitive risk measures and factor exposures in an aggregate wealth portfolio as well as its bond and stock sub portfolios. This is accomplished with data access to well-defined individual security and fund characteristics (distributions of credit ratings, maturity structure, bond sectors, stock capitalization, stock value/blend/growth, stock sectors and geographic location). The process has the user think in terms of over and under investment weights relative to their benchmark strategy.

The Assist™ Tool

An optimizer can only allocate money to existing assets in your accounts. How do you know what necessary opportunities are missing? Ripsaw’s unique benchmark and exposure driven Optimizer™ does need the right investment options to reduce deviations from your benchmark strategy as much as possible. We thought of how to deal with that too! The Ripsaw Assist™ tool analyzes any optimization solution and identifies risk exposure underweights relative to your benchmark strategy. Then it suggests additional investments from its proprietary screener to choose from, add the selected choice to specific accounts and re-optimize. Together, the Ripsaw OptimizerTM and AssistTM tools complete the disciplined investment process for portfolio construction, monitoring and revision.