Set goals, plan, and determine your path

Innovative Wealth Management Toolset

Ripsaw Wealth Tools provides powerful financial tools that let you manage all your wealth as one smart portfolio and achieve your financial goals!

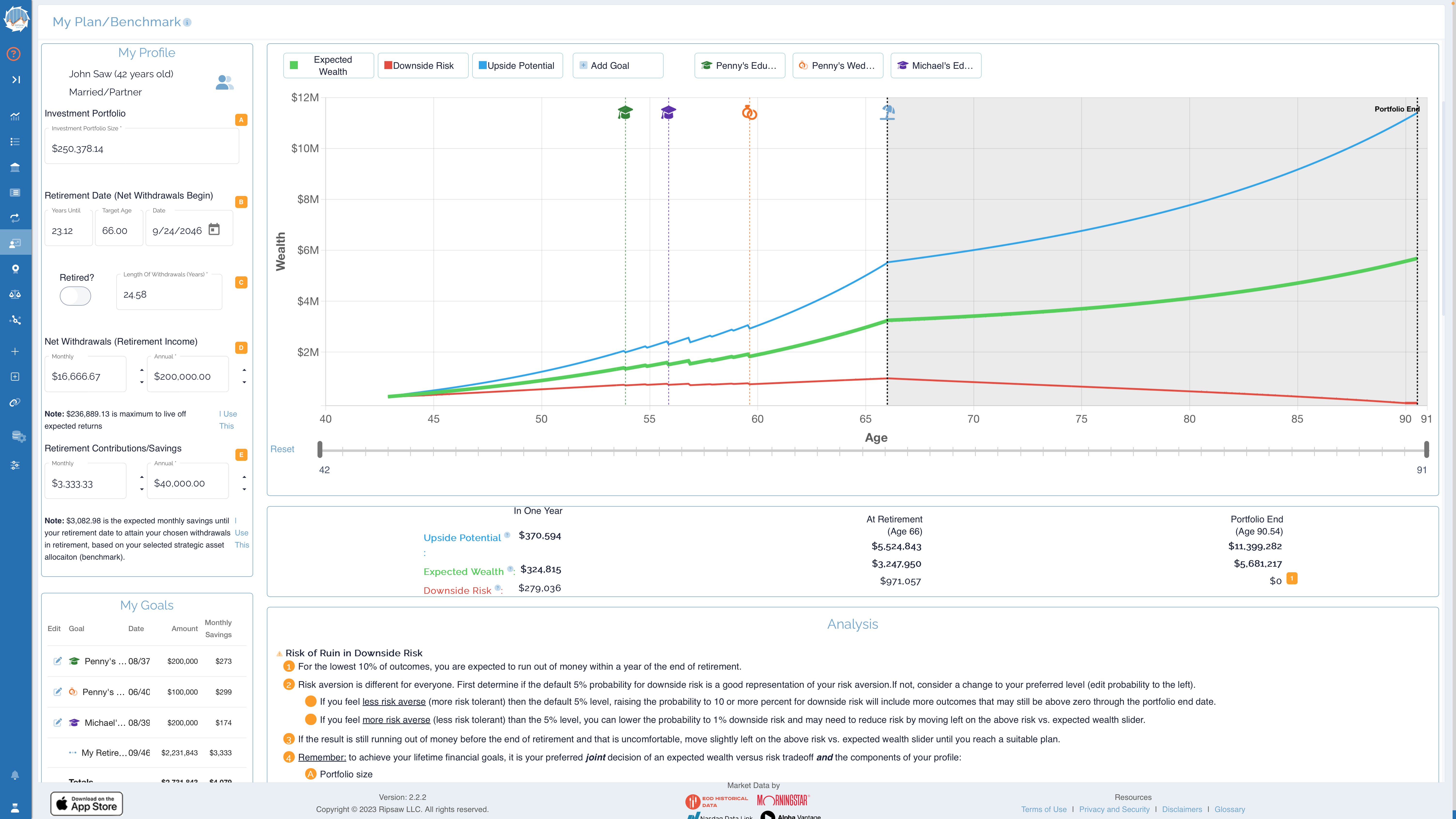

Wealth Planning & Goals

Guided Onboarding

Ripsaw® Members can get started with the right guidance to be successful leveraging the Wealth Tools. Intake workflows that gather all your custom information for inputs in financial planning and portfolio management. Ripsaw takes you through all the steps to get started and on your way!

Lifetime Wealth Planning

A truly comprehensive solution for the simultaneous decisions required for planning goals and investment objectives. Using the current market’s forward-looking lifetime probability distribution of outcomes to show you wealth expectations in the future.

- Dynamic, accessible, live, comprehensive, simultaneous decisions for goals and investment objectives with lifetime probability distributions of outcomes based on current forward-looking market offerings.

- Evaluate the savings, spending and investment decision trade offs over your lifetime.

- Provides a current market analysis for the feasibility and downside risk of your goals. The risk of ruin are outcomes that run out of money prior to the user’s goals, especially in retirement.

- Determine tradeoffs among competing goals.

- During the planning process, a user reveals their preferred lifetime expected wealth versus risk tradeoff that realistically accomplishes their goals and satisfies their investment objectives

Discover the plan that determines how much you need to save, when you want to retire, how much you can spend in retirement, how long will that spending last and how much you can expect to leave your heirs and others.

Retirement and Goal Planning with downside risk and upside potential probabilities of wealth accumulation.

Range of Expected Wealth versus Risk tradeoffs to help choose your preferred benchmark.

Ripsaw analyzes your plan with initial inputs (goals) and provides suggestions on how to adjust your inputs to provide a feasible preferred plan.

My Custom Derived Benchmark

Your uniquely selected set of actual investment funds defines your benchmark risk tolerance (strategic asset allocation) is determined in lifetime wealth planning. Intended deviations from your benchmark represent a tactical asset allocation in order to take advantage of temporary market disruptions, valuation assessments, and supply/demand imbalances. Wealth portfolio return deviations from your benchmark represents measurable performance evaluation.

Financial Goals

Whether it’s a down payment on a new home or saving for a wedding, big purchases or life events can be daunting. People always ask “can I afford that?”. With Ripsaw’s financial goals you can answer those big questions. Add and manage your Financial Goals & Life Events and see their impact on your Lifetime Wealth Plan! You can truly explore tradeoffs of everything in your long term financial life!

Workspaces

Collaboration

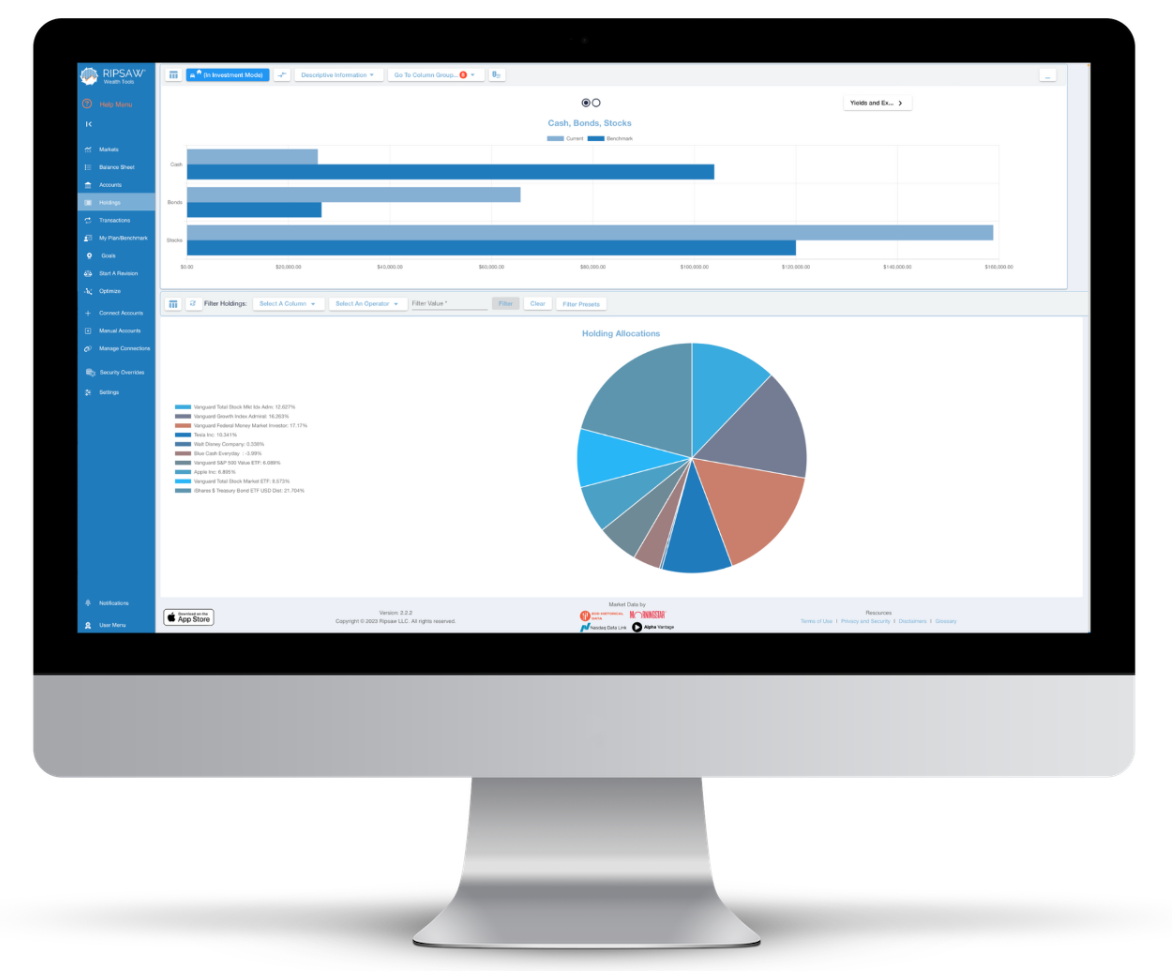

See Complete Wealth Picture

Manage your stock portfolio and investments with automatically updated and readily available investment tracking tools compared to a custom benchmark

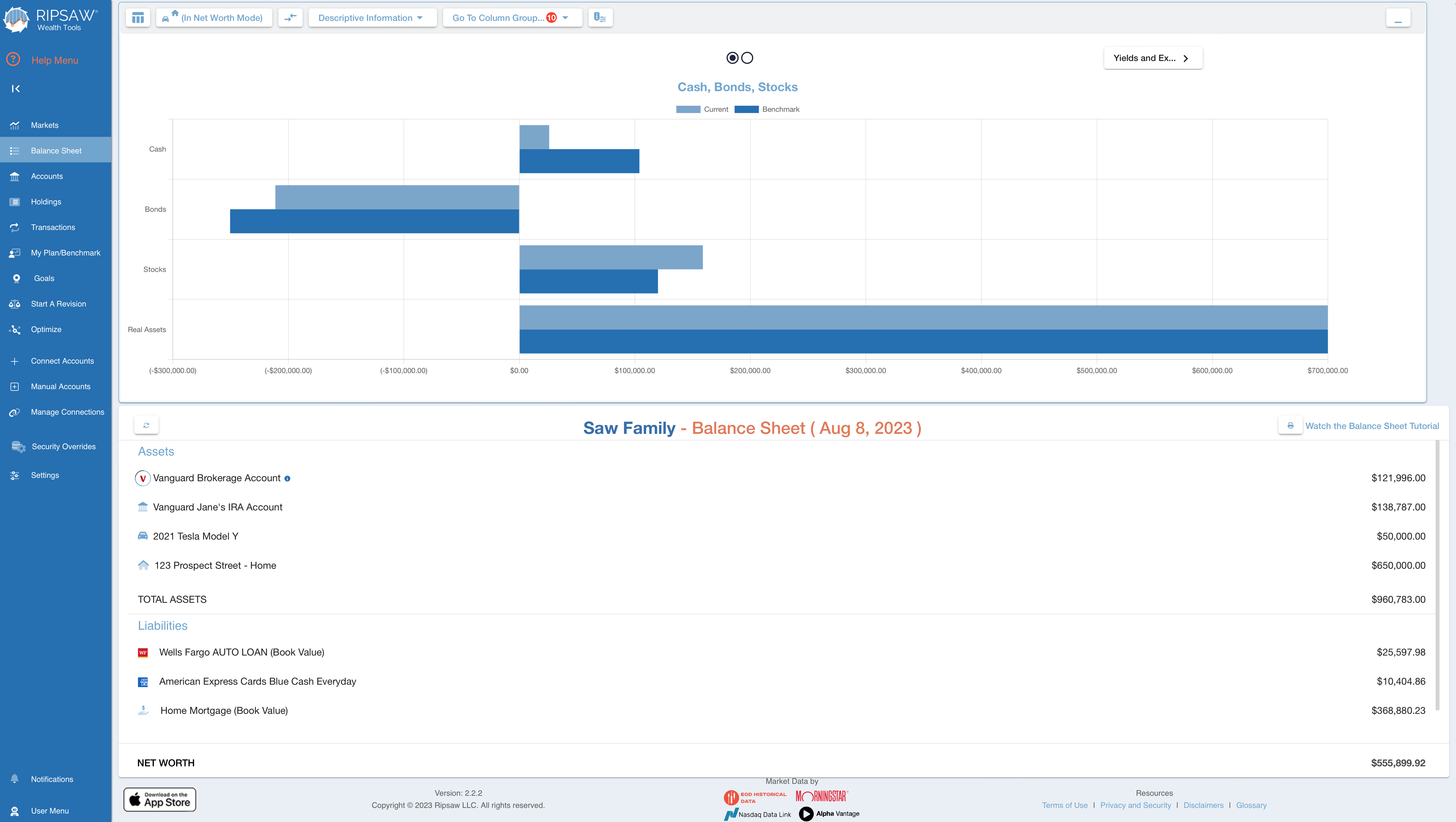

Balance Sheet and Accounts

Your Balance Sheet and individual accounts have access to all of your web-based bank, brokerage, tax-deferred and loan accounts through connected accounts. Assets and liabilities can also be added and modeled manually. In the Accounts view see your investments organized by accounts with relative aggregate information such as fees and composition.

Measure My Portfolio vs. My Benchmark

Your uniquely selected set of actual investment funds defines your benchmark risk tolerance (strategic asset allocation). Intended deviations from your benchmark represent a tactical asset allocation in order to take advantage of temporary market disruptions, valuation assessments, and supply/demand imbalances. Wealth portfolio return deviations from your benchmark represents measurable performance evaluation.

Investment Screener

The advanced Investment Screener is designed to be an efficient tool to search and add securities with specific risk exposures and characteristics to accounts in order to achieve your desired wealth portfolio strategy. You can also use the screener to filter for low expense ratios and thus reduce fees on your investments.

Monitor & Analyze

Your full wealth picture enriched with analytics

Wealth Portfolio Dashboard

Monitor your personal wealth from any of your devices. The Wealth Portfolio Dashboard is your home base for indications of portfolio construction, monitoring portfolio drift, and revision decisions. Your investment portfolio is enriched with data from various sources for dimensioning and analysis. Compare your aggregate risk dimensions with a customized benchmark in Net Worth or Investment mode. The dashboard also lets you see expenses and yield across your entire portfolio compared to your benchmark. Great for reducing fees and seeing yield impact on portfolio changes.

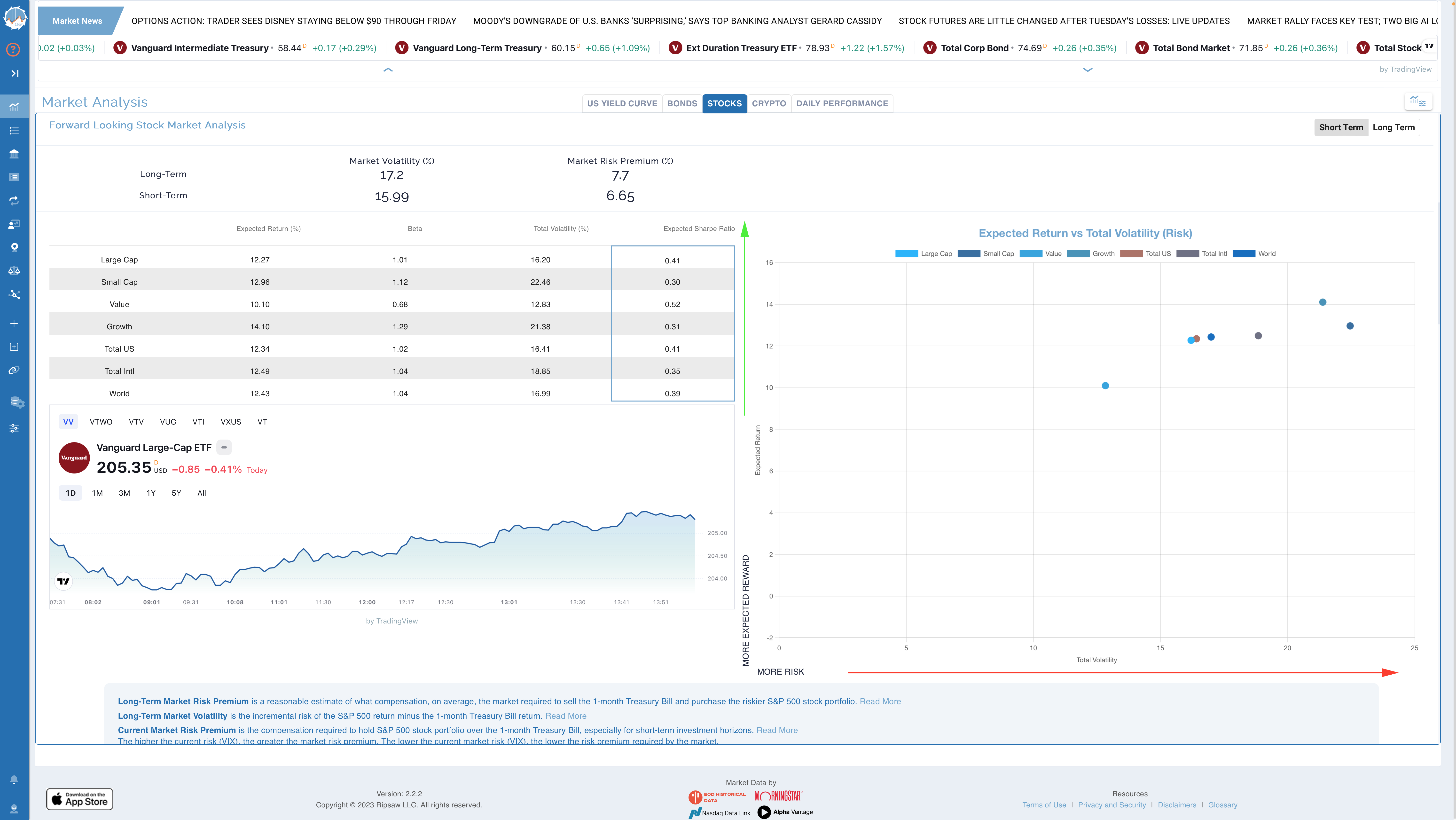

Market Analysis & Information

It is important to understand current market conditions for your portfolio decisions by seeing what the market is offering going forward in terms of expected return and risk dimensions. The toolset lets you keep an eye on the forward-looking volatility measure (VIX) and the Treasury yield curve. With these inputs and additional analytics, forward-looking expected return, volatility and correlations are derived for defining opportunities in the bond, stock, and crypto markets.

Monitor market movements and volatility right in Ripsaw®. See how the market is interpreting the arrival of new information.

Daily Performance Breakdown Comparison

Compare the changes in value of each of your portfolio holdings with that of your customized benchmark as a source of performance attribution. The performance of your benchmark constituents indicate what is driving market movements.

Benchmark Deviation Indicator

Portfolio benchmark deviation indicators help avoid drifting too far away from your objectives. Adjust deviation thresholds to personal preferences.

Configurable Data Views

Create custom views , filter and sort, and analyze over 70 reference data and risk exposure dimensions.

Charts & Graphs

Data visualizations for detailed asset allocation and to help evaluate portfolio composition differences from your custom benchmark.

Holdings Analysis

The Holdings Analysis feature allows the user to view their wealth portfolio by each investment. That is, aggregating the same investment held in multiple accounts. This view gives the user the relevant percentage of their total wealth portfolio allocated to each investment for return impact and diversification analysis. The full set of security specific details available in Account view are also available in Holdings view plus additional information on fund investment strategies and historical price charts. From the Holdings view, Ripsaw® also provides a mapping and access to which accounts each security is held and their respective unrealized capital gains/losses. This is useful information before executing a portfolio revision.

Data Quality Checks and Notifications

Automatic data checks that help you manage your reference data so that it is ready to take advantage of Ripsaw® Wealth Tools. This is part of the Ripsaw® Notifications feature. Here you will also see news, information, and alerts.

Security Data Overrides

Ripsaw® uses multiple quality sources for security data. However, there is no perfection. We must anticipate that there will be situations from time to time in which pieces of data are not available, misclassified or erroneous.

Ripsaw® has a data override function for this purpose to make corrections and maintain them. When security data is more accurate the rest of the Ripsaw® Wealth Tools suite serves you best with the most possible precision.

Transactions

This handy feature shows all transactions; breaks down your income and expenses, and shows net savings on a monthly basis. Easily identify areas where you can cut back, while also keeping track of various income sources in one easy-to-use dashboard.

Revise & Optimize

Revise and optimize toward your target asset allocation

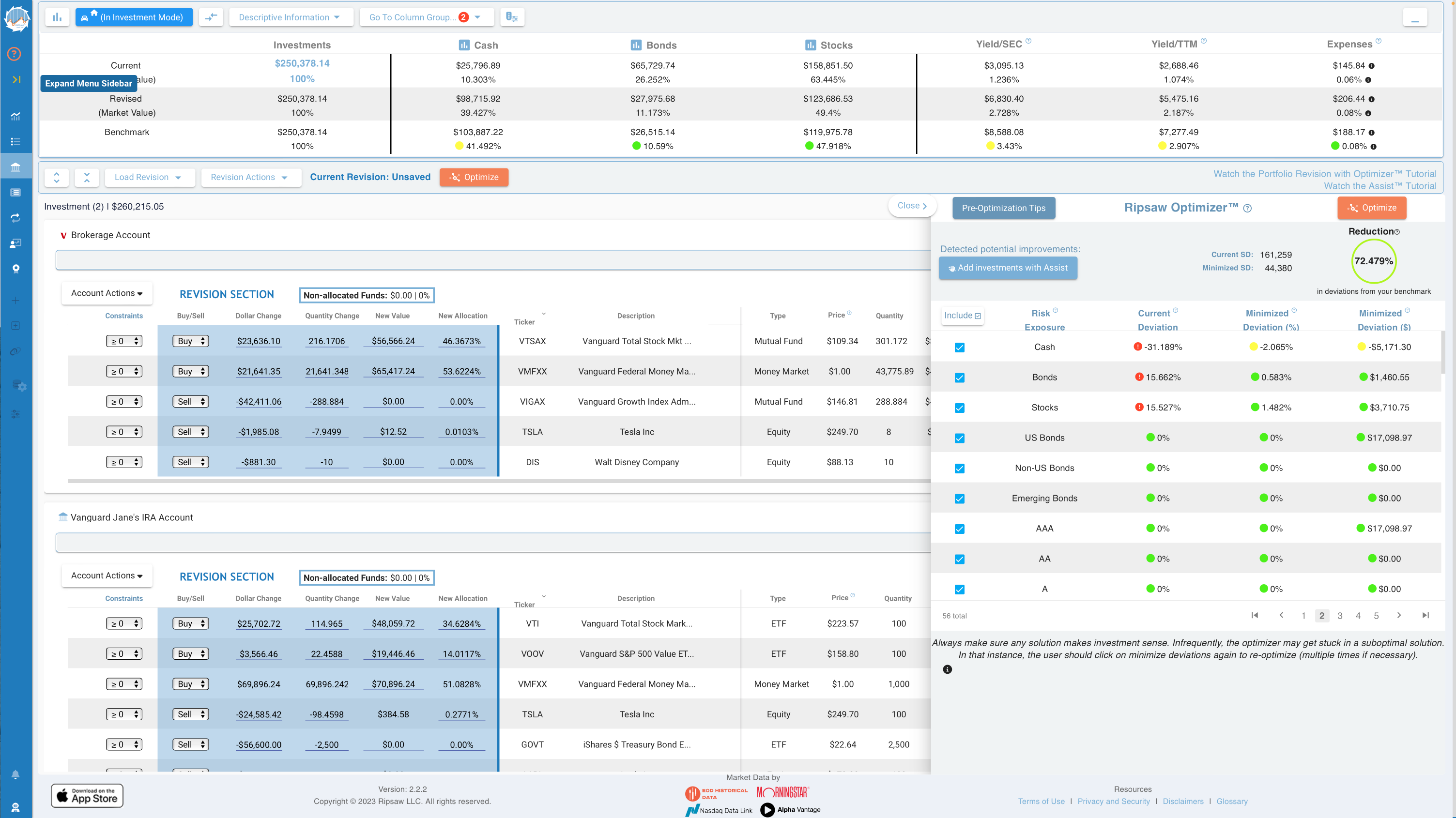

Portfolio Revisions

Run “what if?” scenarios and manage your cash, bond, stock and real asset allocation; stock and bond global exposures; bond default, interest rate and sector risks; stock capitalization, growth, value and sector tilts; expected expenses, yield and income. You can simulate trades, adding new assets and liabilities to your portfolio, allocation changes, etc. When you complete a revision you can save it and see a summary of the moves to make to execute.

Ripsaw Optimizer™

The unique and powerful algorithmic based Ripsaw Optimizer™ makes it easy for you to manage your wealth. Your asset allocation decision can be the most time-consuming and calculation intensive activity in wealth management. The Ripsaw Optimizer™ is designed to solve for your preferred asset allocation across numerous securities with 56 risk dimensions across many accounts with one click. These portfolio optimization tools allow you to set your unique constraints and find solutions to manage your wealth portfolio close to your defined benchmark.

Additionally, the Assist™ tool identifies the missing pieces your portfolio, the underweights compared to your benchmark. It screens for available investments that satisfy and adds them to your account(s) and performs an updated optimization.

Revise for Life Events

You can simulate adding new assets and liabilities to your portfolio with easy-to-use wizard-based revisions for life events such as an annuity purchase, receiving social security or pension benefits, home and vehicle purchases or sales. Then, you have full knowledge of the impact of big decisions on your true wealth picture before executing.