Investment Opportunities

Investing can be a complex and daunting endeavor, often filled with uncertainties and risks. In this ever-evolving financial landscape, understanding the fundamental principles of investment opportunities is essential for achieving long-term financial success. In this blog post, we will delve into the concepts of diversification and risk management, exploring how these principles can guide your investment decisions in a world brimming with opportunities.

Diversification: Spreading Your Wings

Diversification is a term that frequently surfaces in the world of finance, but what does it truly entail? At its core, diversification is about spreading your investments across a range of assets to reduce risk. It’s the age-old wisdom of not putting all your eggs in one basket. But let’s delve deeper.

Imagine you’re faced with the choice of investing in the automobile industry. Back in the 1960s, it was dominated by the “Big Three” – GM, Ford, and Chrysler. Opting for just one of these giants would have meant making numerous assumptions about the future. Could you really outperform the collective knowledge of all market participants who set prices based on countless variables, from supply chain performance to geopolitical forces?

This is where diversification comes into play. Rather than trying to pick the industry’s winner, diversifying allows you to benefit from the industry’s growth, regardless of the individual outcomes of companies. In this case, it’s evident that including non-U.S. car companies in your portfolio is a prudent move. By holding a diversified mix of global car manufacturers, you’re not staking your fortunes on a single bet; you’re positioning yourself to reap the rewards of worldwide economic growth.

This principle extends across all industries. The theory of diversification underscores that firm-specific risks are diversifiable, meaning companies don’t have to offer extra compensation for risks that market participants aren’t demanding. Therefore, constructing a well-diversified portfolio is a practical approach, often achieved through low-cost index mutual funds and ETFs.

But there’s more to consider. The real world isn’t a perfect model. It’s characterized by costs, structural differences, and personal assets that affect your overall risk-taking capacity. These factors make your optimal wealth portfolio unique to you. So, the theoretical value-weighted portfolio of all assets on the planet may not fit your individual circumstances. This is where the art of portfolio customization comes into play, tailored to your financial goals and risk tolerance.

U.S. Treasury Securities: Navigating the Yield Curve

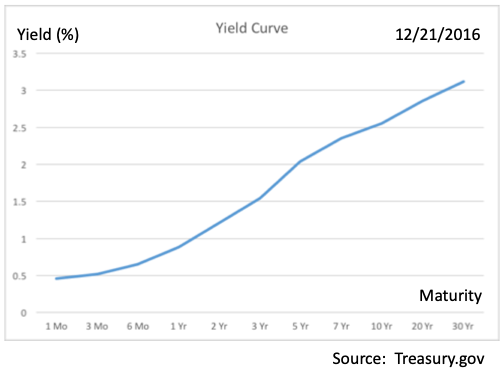

U.S. Treasury securities are the bedrock of the financial world. A U.S. Treasury yield curve provides a visual representation of yields versus maturities, guided by expectations for inflation, real interest rates, and maturity premiums. However, managing the risks associated with these securities requires a deeper understanding.

Investors are primarily concerned with real returns, as they determine purchasing power. Managing interest rate risk requires continuous duration matching to your investment horizon, as the sensitivity of bond prices to future interest rate changes depends on the timing of expected coupon and principal payments.

Corporate Bonds: Unpacking the Risks

Corporate bonds present an intriguing alternative to Treasury bonds, but they come with their own set of risks. Default risk, liquidity risk, and embedded options make corporate bonds unique. To discern the incremental compensation required, focus on what sets them apart.

Using a duration-matched Treasury bond as a benchmark, calculate the promised spread (additional compensation) of a corporate bond. This involves complex modeling of default probabilities, bankruptcy costs, and the impact of refinancing and convertibility options. Since these models vary among financial institutions, they create room for differing opinions, trading strategies, and ultimately, investment performance.

Mortgage-Backed Securities (MBS): Navigating the Complexities

Mortgage-Backed Securities, or MBS, introduce a different dimension of risk. Agency MBS enjoy government backing, minimizing default risk but introducing prepayment uncertainty. Private Label MBS bring added complexity with default and liquidity risks. Estimating expected risk premiums for MBS requires modeling future interest rates and prepayment rates across various scenarios, a task not for the faint-hearted.

Common Stocks: The Infinite Game

Common stocks differ from fixed income securities in their infinite lifespan. Stocks promise a time-series of cash flows in the form of dividends and capital gains. Valuing them involves assessing risks and discounting expected cash flows at appropriate rates. From fundamental analysis to priced risk factors, stock valuation encompasses a spectrum of methodologies.

Conclusion

Navigating the world of investment opportunities demands a blend of theory and practicality. Diversification, risk management, and a thorough understanding of the unique characteristics of different asset classes are key. Whether you’re exploring Treasury securities, corporate bonds, MBS, or common stocks, always remember that your financial journey is a unique one, and your portfolio should reflect your individual circumstances and goals.

In the ever-evolving financial landscape, one thing remains constant: the importance of informed decision-making. By leveraging these principles and staying attuned to market dynamics, you can chart a course toward financial success, even in a world filled with complexities and uncertainties.

Luckily, Ripsaw has tools for helping you plan and implement a well-diversified portfolio!