When you want to understand your personal finances, measuring net worth can be a great place to start. You may have heard about net worth in the context of celebrities or tech titans, but everyone has a net worth. It’s important to know, since your net worth gives you a top-level overview of your finances.

Although understanding your net worth isn’t the most important key to unlocking the details of your finances, it’s a helpful barometer of where things stand—and where you might be able to make improvements.

Let’s discuss how to calculate net worth, what this number means for your finances, and why net worth is important to track.

What is net worth?

Net worth is the product of all your assets (things you own of value) and all your liabilities (debts). Think of it as the bottom line of your personal financial statement or balance sheet.

How to calculate your net worth

Your net worth is the dollar amount of your assets minus your debts. By subtracting your liabilities from your assets, you may determine your net worth. You will have a positive net worth if your assets outweigh your liabilities.

Common assets to include in your net worth calculations may include (but are not limited to):

- Investments

- Bank account balances

- Brokerage account totals

- Retirement account funds

- Homes

- Other real estate

- Automobiles

- Jewelry

- Collectables

- Commodities

- Other outstanding valuables

Liabilities typically include (but are not limited to):

- Outstanding mortgage totals

- Credit card debt

- Personal loan balances

- Home equity line of credit

- Student loans

- Medical bills

- Other outstanding debts

For example, a person with total assets of $500,000 and $210,000 of debt would have a net worth of $290,000.

How knowing your net worth can help you track your financial health

Your net worth is about more than just a monetary figure: for instance, knowing what your net worth is can help you determine if you can afford major purchases or qualify for a loan. Net worth and the inputs into it can help you determine if you can afford a new house or car.

You can see your larger wealth picture if you have access to your net worth easily, you’re better able to address the basics of your financial situation.

How to track your net worth & financial health

Your net worth provides you with a baseline understanding of your finances. It helps you determine where things stand in terms of what you own and how much money you have, as well as what kind of debts might be holding you back from a higher net worth. Plus, it’ll help you better understand the underlying value of your non-liquid assets, which may otherwise go unnoticed when looking at your broader financial picture.

Keeping track of your net worth can serve as an important component of your overall financial health. If your net worth increases, you can usually take that as a sign that you’re doing a decent job of staying on top of debts. If, on the other hand, your net worth drops, you can take this as a sign that there might be room for improvement in terms of your spending or borrowing.

No matter what your net worth is, it’s always helpful to keep on top of your financial trends.

How do I calculate my Net Worth easily and often?

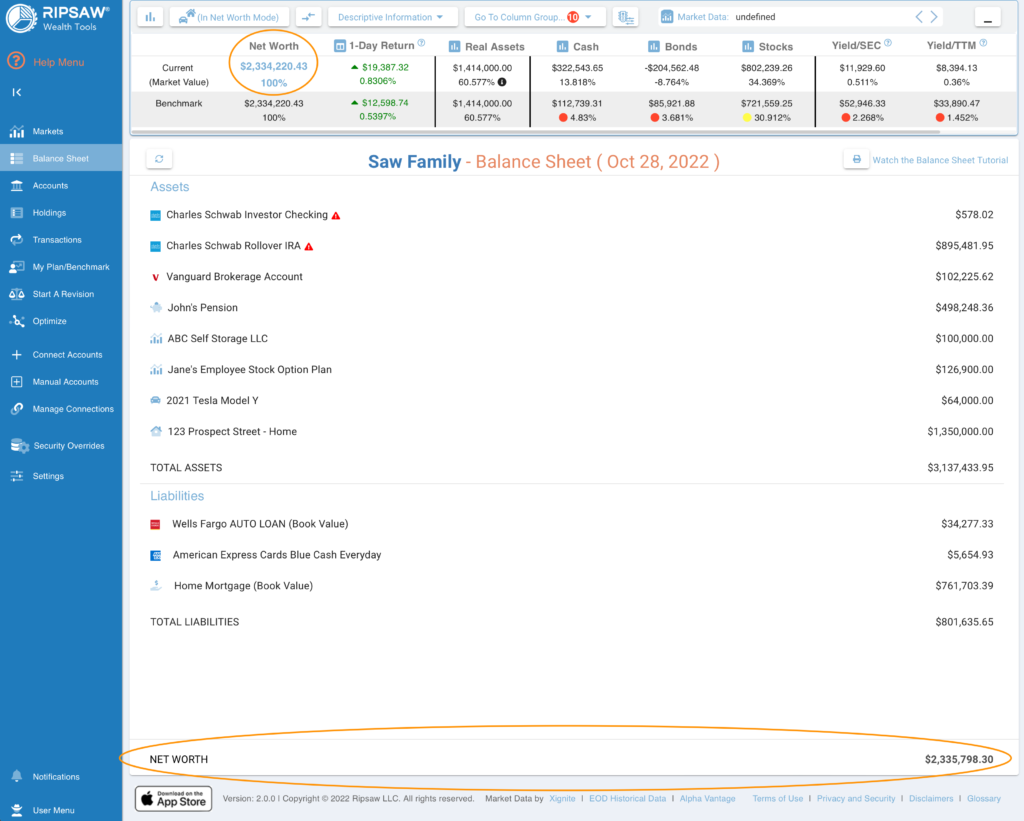

Technology and data now allows you to have a near live net worth available anytime using a wealth aggregator like Ripsaw® Wealth Tools. Ripsaw securely connects to all your financial institutions and aggregates and enriches your data into a personal financial statement or balance sheet.

Additionally, Ripsaw gives you a Wealth Portfolio Dashboard that compares your aggregate risk dimensions with a customized benchmark analyzing your data in either a Net Worth or Investment mode. The dashboard also lets you see expenses and yield across your entire portfolio compared to your benchmark. Great for reducing fees and seeing yield impact on portfolio changes.

Net worth is one piece of the puzzle, but understanding your whole wealth picture, asset allocation, and all the components and related risk reward trade offs is how you can take control of your financial life. Ripsaw also has tools for portfolio construction, monitoring portfolio drift and revision decisions. Further, the ability to see all your transactions, holdings, performance, and monitor the markets. Ripsaw also lets you manage everything as one smart portfolio. Ripsaw Wealth Tools is free to try.