We are super excited to announce the arrival of Ripsaw 2.0! Thanks to the team who has been working hard all summer to bring this to fruition! This major update brings a whole new experience with the Lifetime Wealth Planning Tools. Also new Guided Onboarding, and Smart Benchmark Portfolio Selection, Transactions Tool (July), Markets (May) and user experience improvements across the board. This is the first big release of the awesome new features coming soon to Ripsaw. Learn more below about Ripsaw 2.0!

New in RIPSAW® 2.0

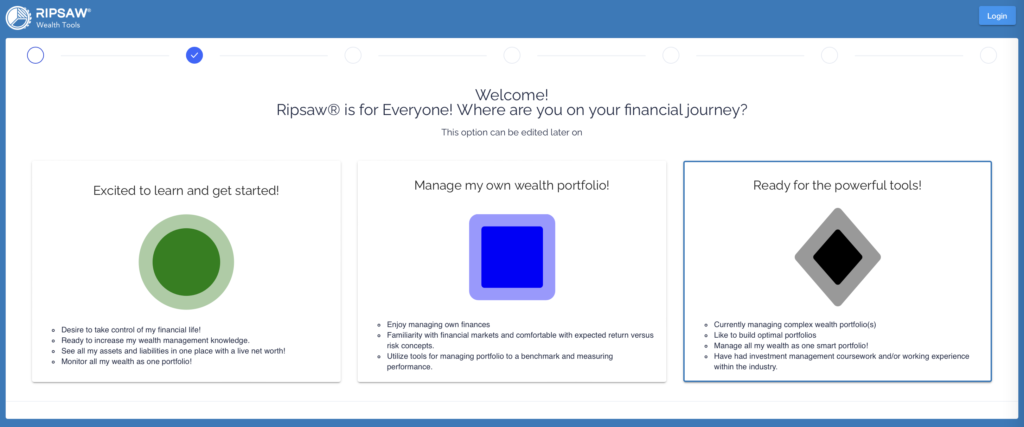

Guided onboarding

Now new and existing users can get started with more guidance. Intake workflows that gather all your custom information for inputs in financial planning and portfolio management. Ripsaw takes you through all the steps to get started and on your way!

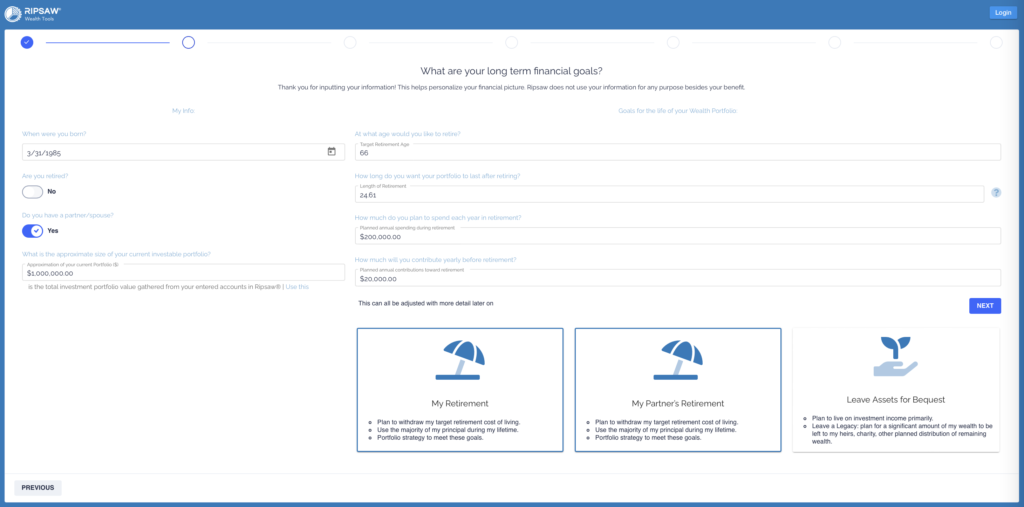

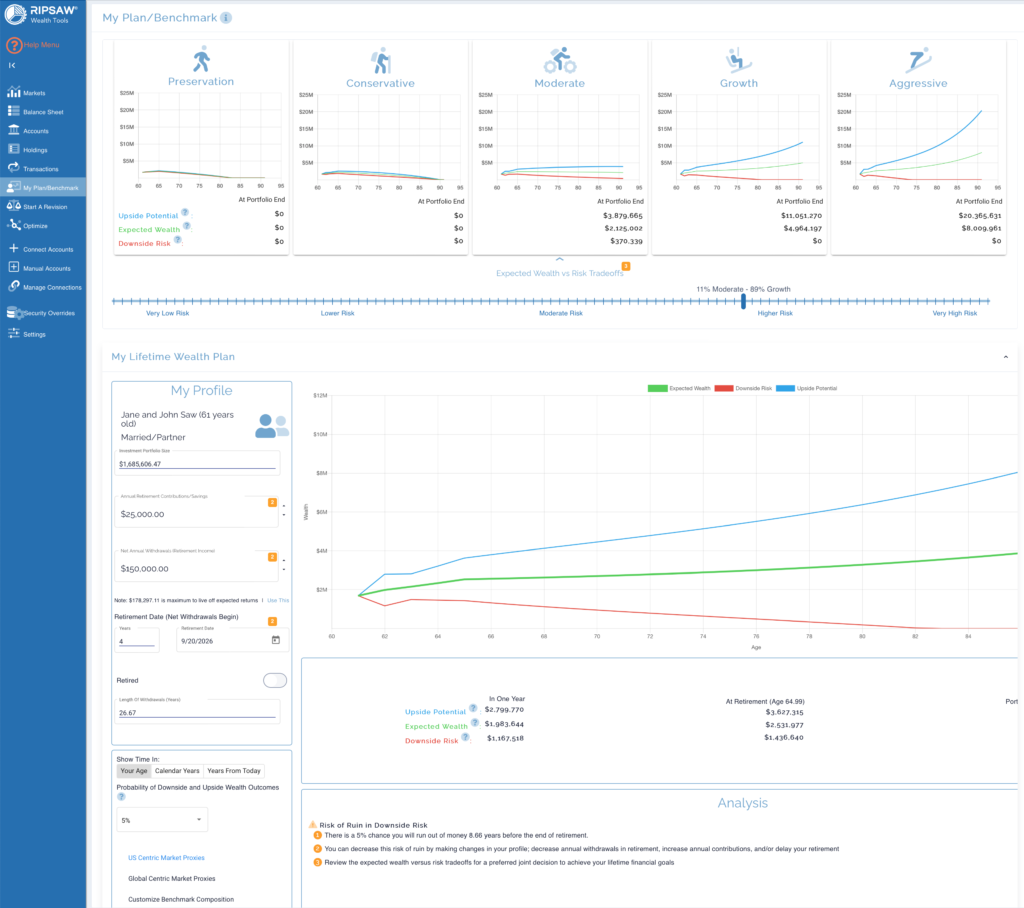

My Plan/Benchmark

- Your new lifetime wealth planning tool is a simultaneous set of decisions including these key variables:

- Current portfolio size

- Retirement date

- Annual savings for investment prior to retirement

- Annual net withdrawals in retirement

- Length of retirement

- Expected Wealth vs Risk investment strategy

- Discover the plan that determines how much you need to save, when you want to retire, how much you can spend in retirement, how long will that spending last and how much you can expect to leave your heirs and others.

- Retirement Planning with downside risk and upside potential probabilities of wealth accumulation.

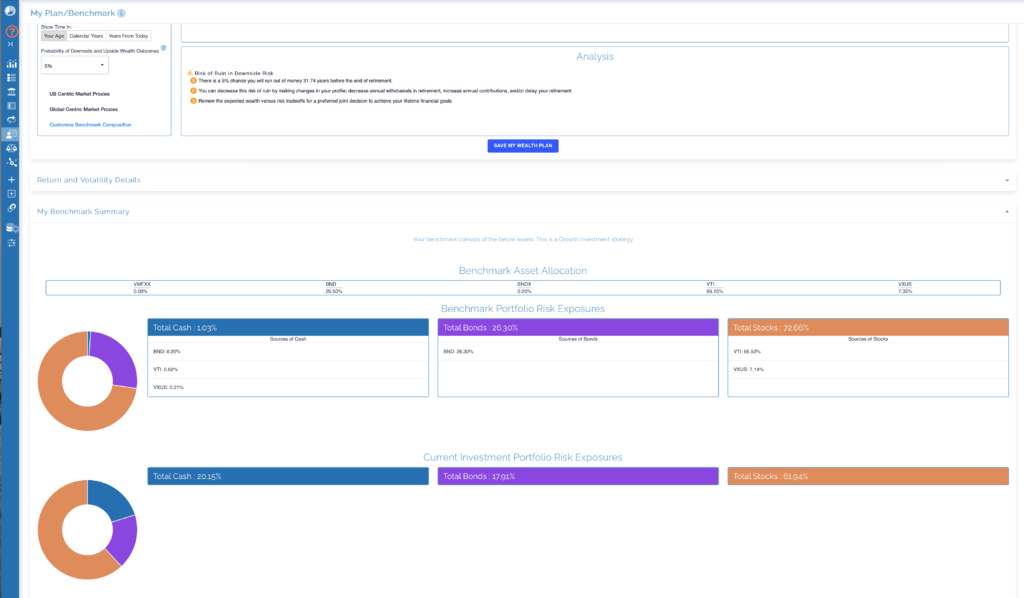

- Range of Expected Wealth versus Risk tradeoffs to help choose your preferred benchmark.

- Ripsaw analyzes your plan with initial inputs (goals) and provides suggestions on how to adjust your inputs to provide a feasible preferred plan.

The output of wealth planning is your new way to choose a suitable benchmark and then use it to manage your wealth. This benchmark is both a measuring stick for your portfolio and with Ripsaw’s Revisions and Optimizer can move your portfolio closer to.

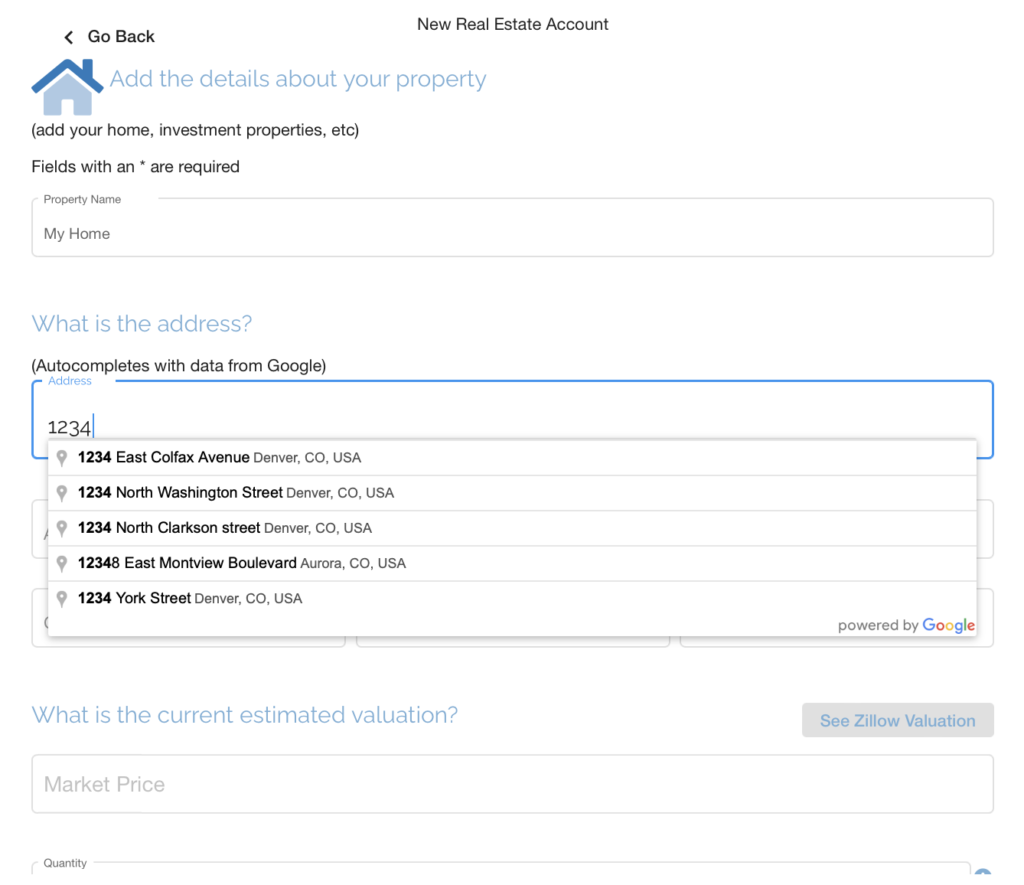

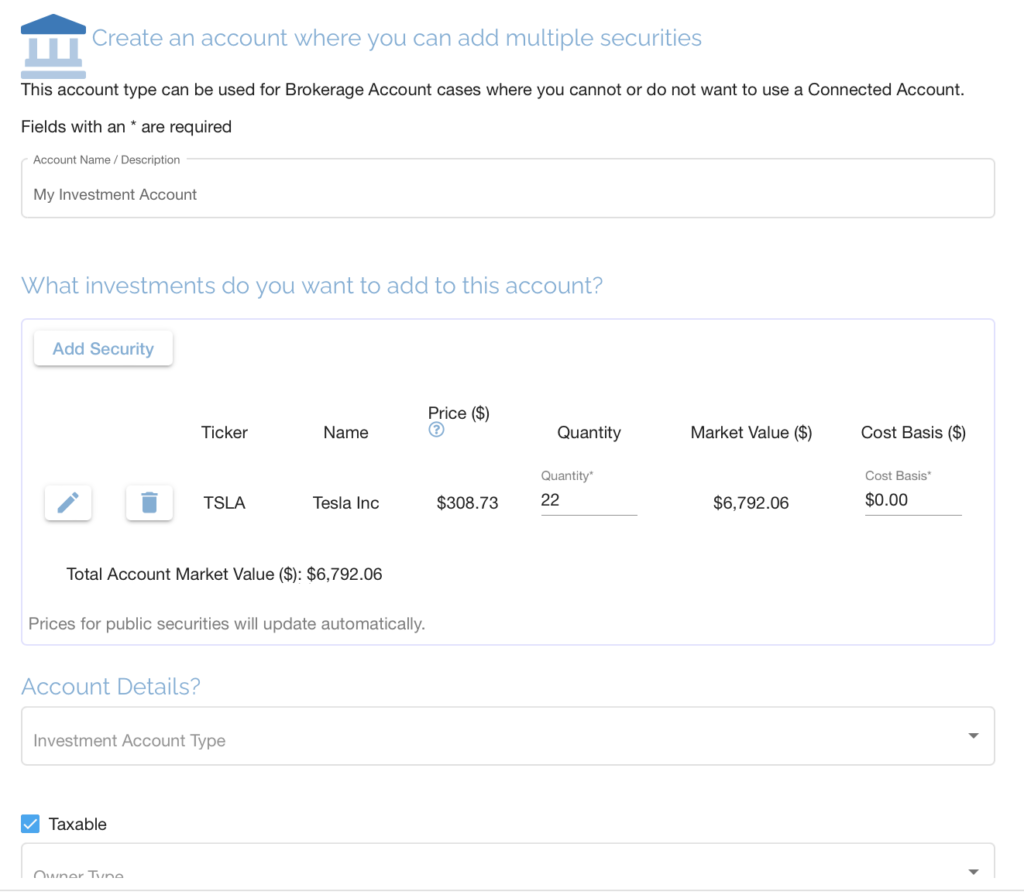

Manual Accounts

- Improved user experience and style.

- Additional guidance on how and what to fill in for each asset and liability type.