We are excited to announce the release of Ripsaw® v 1.8! This release focuses on how current market information improves portfolio decisions.

Introducing the Market Information Toolset:

It is important to understand current market conditions for your portfolio decisions by seeing what the market is offering going forward in terms of expected return and risk dimensions. The wealth management toolset lets you keep an eye on the forward-looking volatility measure (VIX) and the Treasury yield curve. With these inputs and additional analytics, forward-looking expected return, volatility and correlations are derived for defining opportunities in the bond and stock markets. Crypto information is also provided. The Market Information Tools will now be the default starting point when you enter Ripsaw’s wealth management platform. We are also excited to announce that the Markets Tool will be available to everyone no charge at ripsaw.co/markets!

- Advanced Analytics compiled into a great market overview.

- Compare the Yield Curve to previous periods.

- Monitor Treasury Yields, Incremental Maturity Compensation, Modified Duration, Yield Change Volatility, Return Volatility, and the Expected Sharpe Ratio of each maturity.

- Analyze the Expected Return of Bond Sectors vs. Interest Rate Sensitivity Total Risk and their Expected Sharpe Ratios.

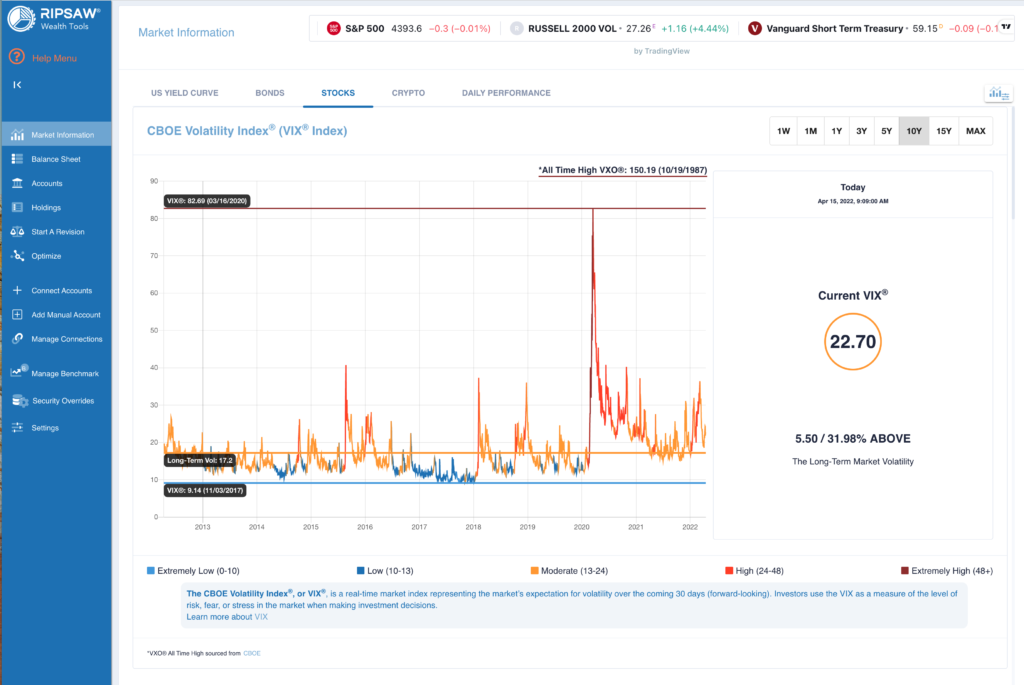

- Compare the current CBOE Volatility Index® (VIX® Index) to volatility history to gain perspective on market volatility and look for opportunities while evaluating risk.

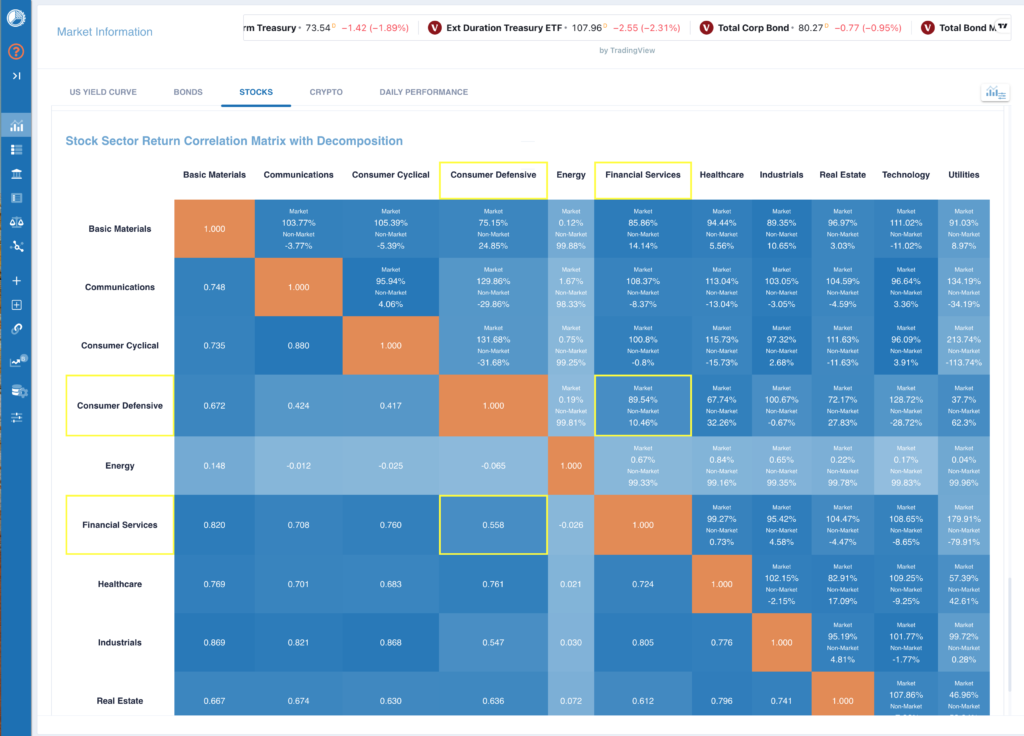

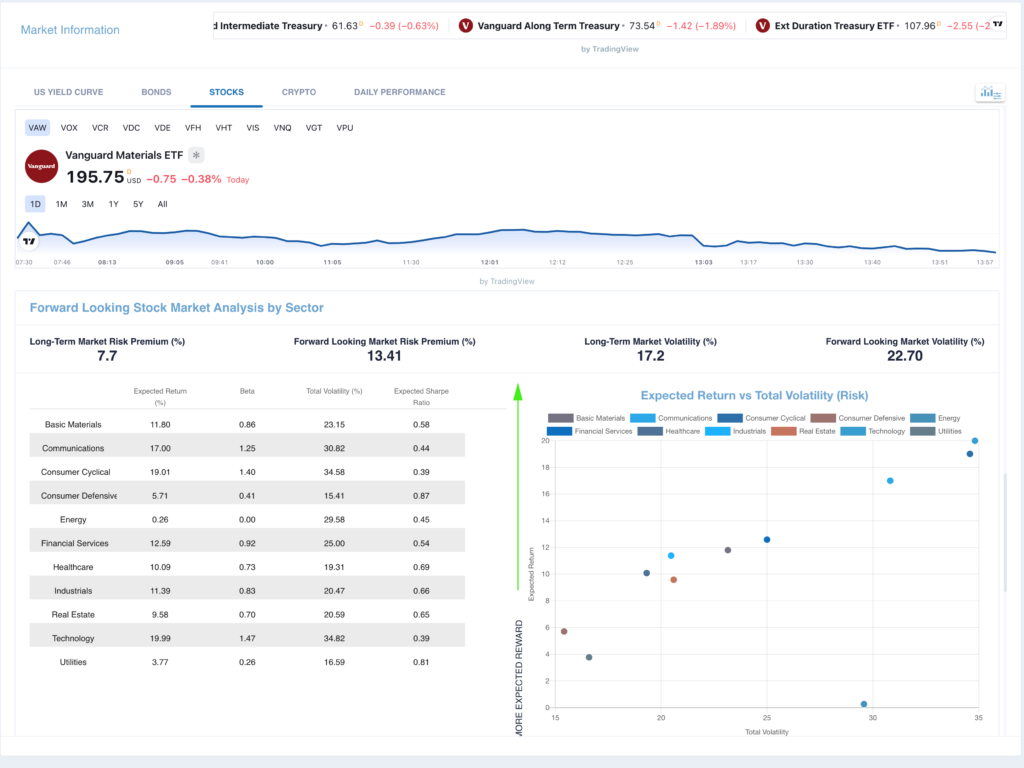

- Analyze what the Stock Market Sectors are offering for Expected Return, Volatility, Expected Sharpe Ratio and the decomposition of their Correlations.

- Provides the daily performance of your personal wealth portfolio versus your custom benchmark.